Source: Photo by Daniel Parks on Flickr

What should Australia do about…

PRC-US technology competition?

By John Lee

Competition in advanced technologies between the People’s Republic of China (PRC) and the United States is rapidly becoming a permanent feature of the international environment. As links between these two giant economies are curtailed, the world’s technological landscape is likely to become increasingly fractured. No country will be unaffected by worsening PRC-US relations due to the outsized roles of each country in global research and development (R&D), especially in information and communications technology (ICT). As a relatively small economy heavily integrated with both the PRC and the US, Australia is particularly exposed. We will face increasingly hard choices to maintain our present level of prosperity and security. Australia needs a new approach to technology policy, one which goes beyond existing interagency processes.

Why does this matter to Australia?

Australia faces long-term economic decline unless Australian industries and workers can exploit new technologies.1 To achieve this Australia requires foreign investment and research partnerships, given our relatively small market and workforce, and persistent under-investment in R&D by Australian governments and industry. The US and the PRC lead the world in R&D spending and are Australia’s most significant academic research partner countries. Companies in both countries are at the global forefront of developing new digitally enabled technologies and implementing them at scale, for example fifth-generation (5G) mobile wireless and the applications built upon it.2

The PRC is technologically and commercially increasingly prominent in Australia’s neighbourhood, especially within the Association of Southeast Asian Nations (ASEAN). PRC firms have invested extensively in digital technology firms and infrastructure across Southeast Asia. The PRC corporate giant Alibaba’s emergence as the Asia-Pacific’s leading cloud computing provider, including the powering of ASEAN’s first ‘smart city’, indicates how pervasive PRC technology may soon become in our region.3 If PRC firms manage to seize first-mover advantages in 5G applications, this will amplify their role throughout ASEAN’s Internet-based economy, which is projected to be worth $US300 billion by 2025.4 The policy choices that Australia makes regarding PRC technology will shape our future integration with these economies, which are expected to be among our most important markets.5

At the same time, Australian policymakers must consider the security implications of the PRC as a technologically capable military power, which employs new technologies for mass surveillance and coercion in ways antithetical to Australian values and international human rights law.6 Australia will also have to manage US expectations of support for policies designed to slow PRC progress in advanced technologies and contain the global expansion of PRC technology firms.

These US policies reflect a structural change that will almost certainly outlast the Trump administration, even though much of the US business community is opposed to ‘decoupling’. Many reports cite American firms lobbying against or circumventing export restrictions concerning the PRC. The president of the American Chamber of Commerce in Shanghai recently described US firms in the PRC as being collectively ‘not in a position to leave this market’.7 But a confrontational stance towards the PRC is the ‘new normal’ across Congress, the field of Democratic presidential contenders, and the US national security establishment.8

US measures

Under President Trump, maintaining a technological lead over the PRC has become a US strategic priority, as stated in the National Security Strategy. The Administration and Congress have introduced various measures to decouple US manufacturing supply chains from PRC firms and more closely control technology transfers to the PRC. These can be grouped into four broad categories.

First, US export controls and foreign investment review regimes are being reformed to bring new categories of ‘emerging and foundational technologies’ (EFT) within their scope. US government agencies have discretion to identify EFTs and to set the level of export controls. New export control regulations are being developed and new foreign investment regulations will come into force in 2020.9

These are likely to reflect a list issued in 2018 for public consultation by the US Commerce Department of ‘representative general categories’ of emerging technologies, which includes artificial intelligence (AI), microprocessors, robotics, 3D printing, biotechnology, quantum information and sensing technology, and advanced surveillance technologies, among others.10 This list overlaps significantly with priority sectors in the PRC’s national economic development and industrial policy plans.

Furthermore, US agencies are required by US law to advocate for the inclusion of unilaterally determined US export controls in multilateral export control regimes (MECRs). For example, if quantum technologies were subjected to US export controls, the US government would seek their inclusion in controlled goods lists promulgated through international processes such as the Wassenaar Arrangement. If successful, this would result in their automatic inclusion in Australia’s defence export controls regime. The US is a member of the four MECRs on which Australia’s Defence Strategic Goods List (DSGL) is based, whereas the PRC participates in only one.

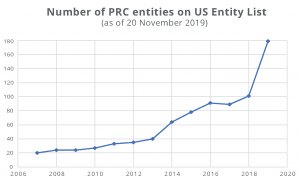

Second, the US Commerce Department has started to add PRC companies and institutions to its Entity List ‘for activities that are contrary to the national security or foreign policy interests of the United States’. This prohibits US firms from doing business with them without a specific license, a prohibition that extends to the sale of non-US made products in which more than 25 per cent of the value consists of controlled US-origin content. For example, because of Huawei’s entry onto the Entity List, there is uncertainty over how long the UK company ARM will continue licensing to Huawei its semiconductor designs, as these reportedly contain some US-origin technology.11

In October 2019, eight more PRC digital technology firms were added to the Entity List, including several that the PRC has officially designated as its ‘national champions’ in developing different AI applications. These firms were added because of their involvement in the provision of surveillance technology in human rights violations in the Xinjiang Uyghur Autonomous Region.12 This is the first time PRC firms have been added to the US Entity List for activities inside the PRC.

Source: US Department of Commerce, Bureau of Industry and Security, Entity List; Dirk van der Kley, “What should Australia do about research collaboration with the PRC?“

Additionally, President Trump in 2019 issued an Executive Order banning transactions in ICT goods or services with an entity in which foreign governments or nationals hold any interest, where the US government has determined that the transaction involves ICT designed or supplied by entities ‘subject to the jurisdiction or direction of a foreign adversary’ and poses a national security risk. The scope of this definition is generally understood to encompass even non state-owned PRC firms, such as Huawei. Authority to implement this Executive Order was delegated to the Commerce Department, which was required to publish associated regulations by mid-October 2019.13

A third category of measures puts indirect pressure on US firms to decouple from the PRC. The chief mechanism here is the progressive imposition of tariffs on PRC goods since March 2018. This has been justified by a US government investigation which concluded that the PRC systematically tries to acquire US technological know-how through illegitimate means. The goal is to incentivise US firms to stop manufacturing finished goods in the PRC.

A fourth group of measures involves tightening access to the US national innovation system. American universities are under growing pressure by the government to monitor PRC nationals involved in advanced technology research. Several bills before Congress at the time of writing would raise reporting requirements concerning PRC-origin funding and deny visas to PRC nationals with military affiliations. Among these, the PLA Visa Security Act states that Australia and other close US allies ‘should take measures similar’.14

PRC response

The PRC has responded to US measures by reinforcing efforts to upgrade its domestic technological innovation. Many PRC firms remain dependent on foreign firms for upstream technological inputs. For example, in 2018 PRC electronics makers imported 95 per cent of their high-end semiconductors.15 Nonetheless, PRC firms are likely to progressively reduce foreign dependence across the board, while occupying upstream positions in transnational production.

The PRC government continues to support international expansion of its firms. Beijing is creating an international digital ecosystem based on PRC proprietary standards and ICT services. PRC telecommunications firms and cloud service providers are building Internet infrastructure worldwide as part of the ‘Digital Silk Road’ within President Xi Jinping’s Belt and Road initiative. Huawei responded to its entry on the US Entity List by accelerating the development of its consumer applications ecosystem in competition with Google and Apple. Huawei is still under consideration as a 5G equipment vendor in numerous countries, including US allies such as the UK, Germany, Thailand and the Philippines.As one recent study noted, while the global Internet’s applications layer is still dominated by US companies, its ‘guts and gears’ are increasingly built by PRC actors.16

Furthermore, the PRC government is likely to continue exerting pressure on foreign firms and governments to cooperate with and give access to PRC firms. Beijing has already expressly threatened foreign firms and governments with retaliatory measures if they relocate operations out of the PRC or deny market access to PRC firms.17 During 2019, the PRC announced the pending establishment of its own ‘Unreliable Entity’ blacklist of foreign firms, and of an automated ‘corporate social credit system’ to reward or punish corporate behaviour.

Implications

Australia can no longer treat science and technology (S&T) issues separately from considerations of espionage, defence technology, diplomacy and economic security. All these factors must be considered before advice to Government reaches Cabinet level. This process should seek to devise long-term policy settings that manage challenges proactively, holistically and innovatively, rather than reactively, piecemeal and in deference to arrangements inherited from preceding decades.

Such a process would help prevent unfolding events, foreign pressure and media coverage from pushing Australian decisionmakers towards unbalanced policy. For example, the public conversation over PRC technology is currently focused on potential espionage, improving PRC military capabilities, and access to Australia’s university system by PRC nationals with military and intelligence connections. Insufficient attention has been given to the long-term challenges of dealing with an international economy and R&D environment in which PRC actors are extensively embedded.

The PRC’s global role in developing digital communications technology and emerging industrial sectors will likely keep expanding, even as Australia faces growing pressure to align with US policies designed to constrain or exclude this PRC presence. Therefore, Australia cannot decouple conflicting economic and security interests, as some have advocated.18 The PRC’s technological advance raises issues across the whole spectrum of Australia’s national interests. An effective response requires integrated policy approaches, which allow Australia to remain innovative, open and its economy competitive.

Policy recommendations

- The National Science and Technology Council should be mandated and resourced to provide input on emerging technology issues and large-scale technological systems to all Cabinet submissions, including those to the National Security Committee of Cabinet. The policy advice would integrate innovation and economic considerations with those of espionage and national defence.For example, agencies would need to involve the Council when providing advice on Australia’s 5G infrastructure or quantum science research. This aims to ensure that advice to government on S&T issues closely linked to security and foreign policy includes potential impacts on Australia’s economic growth and industrial competitiveness.

- The Council needs input from the national security community. As the government’s peak S&T advisory body, chaired by the Prime Minister, the Council should include permanent representatives from at least the Departments of Defence, Home Affairs, Foreign Affairs and Trade, Treasury, and Health as well as the Office of National Intelligence. The Department of Education should also be represented.

- The Council should be required to include input from the university sector, the business community and state governments in its deliberations.

- The Council should have responsibility for oversight of regulations impacting nationwide R&D activity, such as to:

- oversee implementation of guidelines for international research collaborations, developed by the University Foreign Interference Task Force.

- oversee national export controls, based on the principle that such controls must consider impacts on domestic R&D and the economy as well as defence policy. This conforms with the ‘proportionate approach’ advocated in the government-endorsed 2018 Independent Review of Australia’s Defence Trade Controls Act.

Author

John Lee is an independent analyst focusing on the PRC’s foreign and industrial policy. He previously worked at Australia’s Department of Foreign Affairs and Trade and Department of Defence, and was a visiting fellow at the Mercator Institute for China Studies. He holds an LLM International Law from the Australian National University and an MA in War Studies from King’s College London.

China Matters does not have an institutional view; the views expressed here are the author’s.

This policy brief is published in the interests of advancing a mature discussion on PRC-US technology competition and its implications for Australia. Our goal is to influence government and relevant business, educational and non-governmental sectors on this and other critical policy issues.

China Matters is grateful to four anonymous reviewers who received a blinded draft text and provided comments. We welcome alternative views and recommendations, and will publish them on our website. Please send them to [email protected]

Notes

- John Kehoe, ‘Australia risks ‘slow decline’ without reform,’ The Australian Financial Review, June 18, 2019, https://www.afr.com/policy/economy/australia-risks-slow-decline-without-reform-20190617-p51yez

- Dann Littmann and Phil Wilson, ‘5G Deployment: The Chance to Lead for a Decade,’ Deloitte, 2018, https://www2.deloitte.com/us/en/pages/consulting/articles/5G-deployment-for-us.html

- Karamjit Singh, ‘Alibaba Cloud fast becoming leading cloud player in Malaysia,’ Digital News Asia, September 3, 2019, https://www.digitalnewsasia.com/business/alibaba-cloud-fast-becoming-leading-cloud-player-malaysia

- Aradhana Aravindan, ‘Southeast Asia’s internet economy to hit $300 billion by 2025: report,’ Reuters, October 3, 2019, https://uk.reuters.com/article/us-southeast-asia-internet/southeast-asias-internet-economy-to-hit-300-billion-by-2025-report-idUKKBN1WI07X

- Penny Burtt and Mukund Narayanamurti, ‘Unlocking innovation-led growth in Australia and Southeast Asia,’ The Australian Business Review, November 17, 2019, https://www.theaustralian.com.au/business/economics/unlocking-innovationled-growth-in-australia-and-southeast-asia/news-story/3e470b02b9b95f05367596c6c5c7d144

- Chris Buckley and Austin Ramzy, ‘Absolutely No Mercy’: Leaked Files Expose How China Organised Mass Detention of Muslims’, The New York Times, November 17, 2019, https://www.nytimes.com/interactive/2019/11/16/world/asia/china-xinjiang-documents.html

- Ker Gibbs et al. ‘American Business and China: The View From Shanghai,’ Centre for Strategic & International Studies, September 25, 2019, https://www.csis.org/events/american-business-and-china-view-shanghai

- Craig Kafura, ‘The US Democrats’ China Debate,’ The Diplomat, September 02, 2019, https://thediplomat.com/2019/08/the-us-democrats-china-debate/

- ‘Fact Sheet: Proposed CFIUS Regulations to Implement FIRRMA,’ U.S. Department of the Treasury – Office of Public Affairs, September 17, 2019, https://home.treasury.gov/system/files/206/Proposed-FIRRMA-Regulations-FACT-SHEET.pdf

- ‘Review of Controls for Certain Emerging Technologies,’ Bureau of Industry and Security, Commerce, November 19, 2019, https://www.federalregister.gov/documents/2018/11/19/2018-25221/review-of-controls-for-certain-emerging-technologies

- David Kirton and Yingzhi Zhang, ‘ARM to continue supplying chip technology to Huawei,’ Reuters, October 25, 2019, https://uk.reuters.com/article/uk-china-usa-huawei-arm/arm-to-continue-supplying-chip-technology-to-huawei-idUKKBN1X413O

- ‘U.S. Department of Commerce Adds 28 Chinese Organizations to its Entity List,’ U.S. Department of Commerce – Office of Public Affairs, October 7, 2019, https://www.commerce.gov/news/press-releases/2019/10/us-department-commerce-adds-28-chinese-organizations-its-entity-list

- Matthew Kahn, ‘Document: Executive Order Declaring National Emergency on Telecom Supply Chain,’ Lawfare, May 15, 2019, https://www.lawfareblog.com/document-executive-order-declaring-national-emergency-telecom-supply-chain

- Phillip Coorey, ‘US seeks to pressure Australian universities over China research,’ The Australian Financial Review, August 21,2019, https://www.afr.com/politics/federal/us-seeks-to-pressure-australian-universities-over-china-research-20190821-p52j6b

- Lucy Hornby and Yuan Yang, ‘China raises alarm over its dependency on imported chips,’ The Financial Times, July 19, 2018, https://www.ft.com/content/410306d8-8ae0-11e8-bf9e-8771d5404543

- Dwayne Winseck, ‘The Geopolitical Economy of the Global Internet Infrastructure’ Journal of Information Policy Vol. 7 (2017)

- Neha Dasgupta and Sanjeev Miglani, ‘Exclusive: China warns India of ‘reverse sanctions’ if Huawei is blocked – sources,’ Reuters, August 6, 2019, https://www.reuters.com/article/us-huawei-india-exclusive/exclusive-china-warns-india-of-reverse-sanctions-if-huawei-is-blocked-sources-idUSKCN1UW1FF

- Alan Oxley and Innes Willox, ‘Australia must rethink the place of trade in foreign policy,’ The Australian Financial Review, July 13, 2019 https://www.afr.com/politics/federal/australia-must-rethink-the-place-of-trade-in-foreign-policy-20190730-p52c55